gregoryp52298

Sobre gregoryp52298

Understanding IRA Gold Investment: A Secure Path To Wealth Preservation

Investing in gold by an individual Retirement Account (IRA) has gained recognition as a technique for wealth preservation and diversification. As financial uncertainties loom and inflation fluctuates, many traders are seeking alternative assets to safeguard their retirement financial savings. This article delves into the basics of IRA gold investment, its benefits, the means of setting it up, and the concerns to bear in mind.

What’s an IRA Gold Investment?

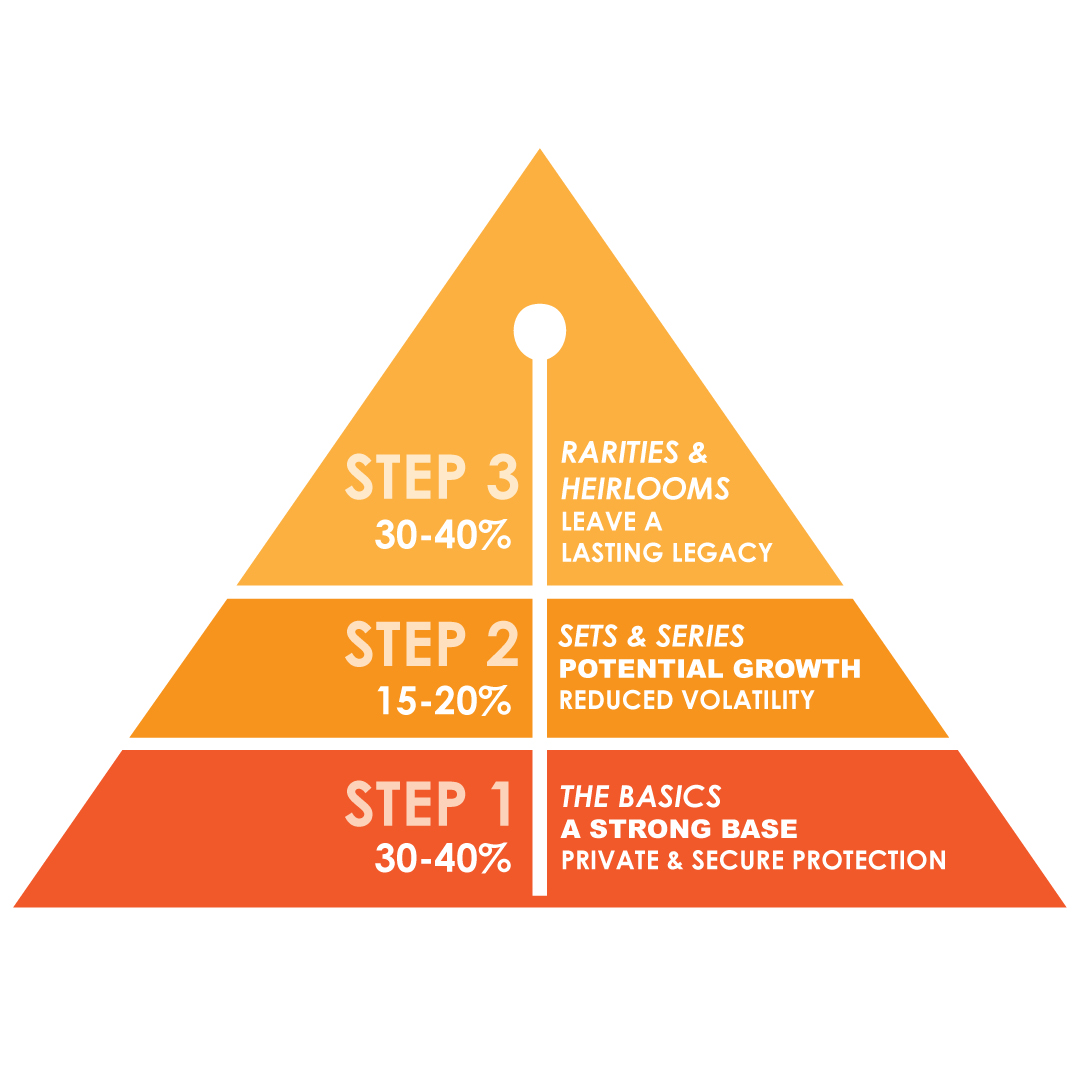

An IRA gold investment allows individuals to carry bodily gold and different valuable metals as a part of their retirement portfolio. In contrast to traditional IRAs, which typically encompass stocks, bonds, or mutual funds, a gold IRA enables investors to diversify their holdings with tangible assets which have traditionally maintained their worth over time.

The advantages of Investing in Gold through an IRA

- Inflation Hedge: Gold has long been seen as a hedge in opposition to inflation. When fiat currencies lose value as a result of inflationary pressures, gold often retains or even will increase its worth. This characteristic makes gold a compelling option for those trying to guard their purchasing energy.

- Portfolio Diversification: Together with gold in an investment portfolio can scale back overall threat. Valuable metals typically have a low correlation with conventional asset classes, which means that when stocks are down, gold might perform properly, offering a buffer towards market volatility.

- Tax Advantages: Gold IRAs offer the same tax benefits as conventional IRAs. Contributions could also be tax-deductible, and the funding can develop tax-deferred until withdrawal. This will lead to significant tax savings over time.

- Tangible Asset: Unlike stocks or bonds, gold is a physical asset which you can hold. This tangibility can provide a sense of security, especially during instances of economic instability.

- Wealth Preservation: Gold has been a store of value for centuries. By investing in gold, individuals can preserve their wealth for future generations, making it an interesting choice for these involved about long-time period monetary safety.

Kinds of Gold that may be Held in an IRA

Not all gold investments are eligible for inclusion in an IRA. To qualify, the gold should meet specific requirements set by the interior Income Service (IRS). The following forms of gold are usually acceptable:

- Gold Coins: Certain coins, such as the American Eagle, Canadian Maple Leaf, and Austrian Philharmonic, are eligible as they meet the required purity standards (at least 99.5% pure).

- Gold Bars: Gold bars produced by approved refiners and assembly the purity necessities can also be included in an IRA.

- Gold Bullion: Gold bullion that meets the IRS criteria for purity and is produced by an accredited source is permissible.

Establishing a Gold IRA

Establishing a gold IRA includes a number of steps:

- Select a Custodian: The IRS requires that each one IRAs be held by a qualified custodian. Search for a custodian that makes a speciality of treasured metals and has an excellent reputation. They may handle the account, handle transactions, and ensure compliance with IRS laws.

- Fund the Account: You can fund your gold IRA through varied methods, together with a direct switch from an current retirement account, a rollover from another IRA, or making a brand new contribution. Be aware of the annual contribution limits and any tax implications.

- Select Your Gold: As soon as the account is funded, you may work along with your custodian to pick the gold merchandise you would like to buy. Be certain that the gold meets IRS requirements for purity and is sourced from permitted manufacturers.

- Storage: The IRS mandates that bodily gold in an IRA be saved in an authorized depository. If you have any concerns pertaining to wherever and how to use just click the up coming site, you can get hold of us at our own web site. Your custodian will assist arrange safe storage on your gold, ensuring that it’s protected and insured.

- Monitoring Your Investment: Often review your gold IRA’s performance and stay informed about market trends. Whereas gold is mostly a long-time period funding, staying engaged can show you how to make informed choices.

Issues Earlier than Investing in Gold IRAs

While investing in a gold IRA may be useful, there are a number of components to contemplate:

- Charges: Gold IRAs usually come with numerous charges, including setup fees, storage charges, and transaction fees. Be sure to grasp the charge structure before committing to a custodian.

- Market Volatility: Whereas gold is commonly considered as a stable funding, its price can nonetheless fluctuate based on market circumstances. It is important to evaluate your risk tolerance and funding objectives.

- Liquidity: Selling gold can take time, and the market might not at all times be favorable. Consider your liquidity wants earlier than investing a big portion of your retirement savings in gold.

- Regulatory Compliance: Be certain that your custodian and the gold merchandise you select comply with IRS rules. Non-compliance can result in penalties and taxes.

- Long-Term Commitment: Gold ought to be seen as an extended-time period funding. If you’re wanting for short-time period gains, gold may not be one of the best choice for your portfolio.

Conclusion

Investing in gold by an IRA could be a prudent technique for these seeking to diversify their retirement portfolio and protect their wealth towards inflation and financial uncertainty. By understanding the advantages, processes, and issues involved, buyers can make knowledgeable choices about incorporating gold into their retirement plans. As always, it’s advisable to seek the advice of with a monetary advisor to tailor your funding strategy to your particular person needs and goals. With cautious planning and consideration, a gold IRA can serve as a strong basis for a safe monetary future.

No listing found.